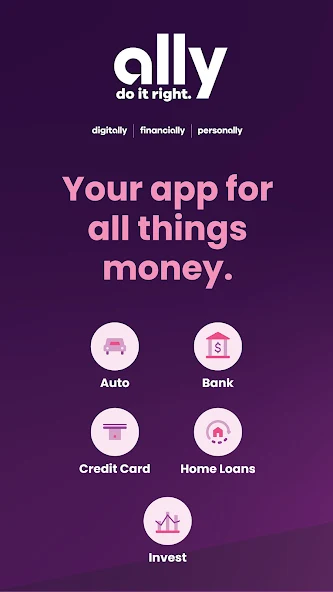

The Ally: Bank, Auto & Invest app is a multifunctional mobile application offered by Ally Financial Inc. that provides users with a range of banking, automotive, and investment services. Within the app, users can manage their Ally Bank accounts, including checking, savings, CDs, and money market accounts. They can also apply for loans, view transaction history, transfer money, pay bills, and deposit checks remotely using mobile check deposit.

Additionally, the app integrates Ally's auto services, allowing users to manage their auto loans, view payment details, and access their vehicle accounts. Users can also get personalized loan and lease options, view vehicle history reports, and make payments towards their auto loans directly through the app.

For investment services, the Ally app enables users to access their Ally Invest accounts, monitor their investment portfolios, trade stocks, ETFs, options, and mutual funds, and stay updated with market news and analysis.

The app features robust security measures, including biometric authentication and account alerts, to safeguard user information and transactions. Available for both iOS and Android devices, the Ally: Bank, Auto & Invest app offers a comprehensive and convenient financial management solution for Ally customers.

The Ally: Bank, Auto & Invest app is a comprehensive financial management platform that caters to the diverse needs of Ally Bank customers. Available for both iOS and Android devices, this app offers a wide range of features designed to streamline banking, auto financing, and investment management, all within a secure and user-friendly environment.

### Key Features

1. **Banking Services**:

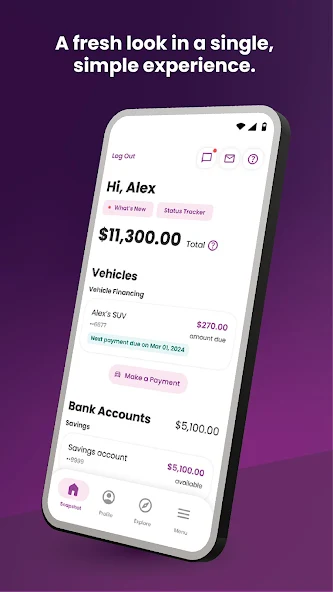

- **Account Management**: Users can access and manage their Ally Bank accounts, including checking, savings, money market, and CD accounts. The app provides a detailed overview of account balances, recent transactions, and account statements.

- **Bill Pay**: Users can schedule and manage bill payments directly from their accounts, with options for one-time or recurring payments. Bill Pay features include setting payment reminders and viewing payment history.

- **Mobile Deposits**: Conveniently deposit checks using the app's mobile deposit feature, eliminating the need to visit a physical bank branch.

2. **Auto Financing**:

- **Auto Loan Management**: Customers with auto loans through Ally can manage their loan accounts, view payment schedules, make payments, and explore refinancing options within the app.

- **Vehicle Information**: Access details about financed vehicles, including loan terms, payoff amounts, and vehicle history reports.

3. **Investment Services**:

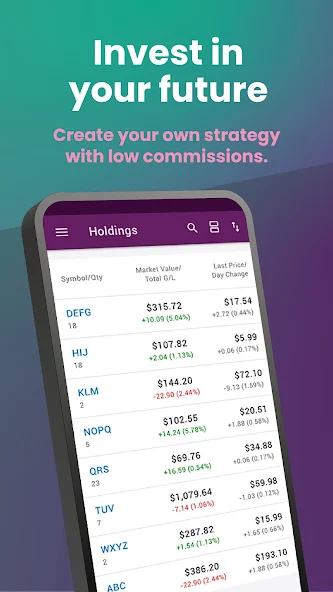

- **Ally Invest**: Seamlessly access Ally Invest accounts to monitor investment portfolios, track market trends, buy and sell stocks, ETFs, and mutual funds, and manage retirement accounts.

- **Trading Tools**: The app provides tools for researching investment opportunities, analyzing market data, setting up watchlists, and executing trades with ease.

4. **Security Features**:

- **Secure Login**: The app offers multiple layers of security, including biometric authentication (fingerprint and facial recognition), PIN, and password protection, ensuring secure access to accounts.

- **Fraud Protection**: Advanced fraud detection and monitoring systems help safeguard accounts, with real-time alerts for suspicious activities and unauthorized transactions.

- **Card Controls**: Users can manage their Ally Bank debit card, including the ability to temporarily lock or unlock the card, set spending limits, and receive transaction alerts.

5. **Customer Support**:

- **24/7 Support**: Access customer support directly from the app, with options for live chat, phone support, and secure messaging. The app also features a comprehensive FAQ section and educational resources.

- **Loan Assistance**: For auto loan customers, the app provides tools for managing loan payments, exploring payment options, and accessing loan-related documents.

6. **Additional Tools**:

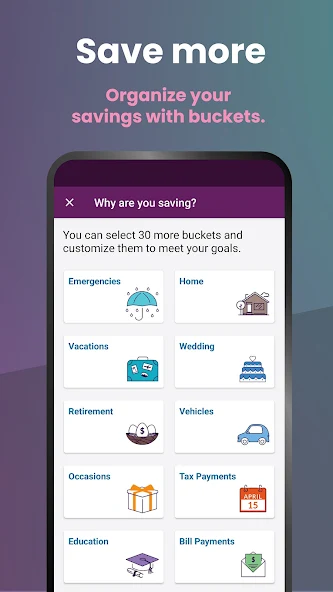

- **Savings Goals**: Set and track savings goals within the app, with progress indicators and personalized recommendations to help users achieve their financial objectives.

- **Budgeting Tools**: The app offers budgeting features, allowing users to categorize expenses, track spending trends, and set budget limits for different categories.

- **Credit Score Monitoring**: Access free credit score monitoring and receive insights and tips to improve credit health over time.

7. **User Experience**:

- **Intuitive Interface**: The Ally app features a user-friendly design with easy navigation and quick access to essential features such as account balances, recent transactions, and payment options.

- **Customizable Alerts**: Users can set up personalized alerts for account activity, payment due dates, low balances, and more, ensuring they stay informed about their financial status.

- **Regular Updates**: Ally regularly updates the app to introduce new features, enhance security measures, and improve overall performance based on user feedback.

### Conclusion

The Ally: Bank, Auto & Invest app offers a comprehensive suite of financial services tailored to meet the needs of Ally Bank customers. From banking and auto financing to investment management and security features, the app provides a convenient and secure way to manage finances on the go. With its intuitive interface, robust security measures, and extensive range of tools and services, the Ally app serves as a valuable companion for individuals looking to take control of their financial well-being.